The 7-Minute Rule for Clark Finance Group

Table of ContentsUnknown Facts About Clark Finance Group Refinance Home LoanThe Ultimate Guide To Clark Finance Group Home Loan CalculatorAll about Clark Finance Group Home Loan CalculatorA Biased View of Clark Finance Group Home Loan Lender

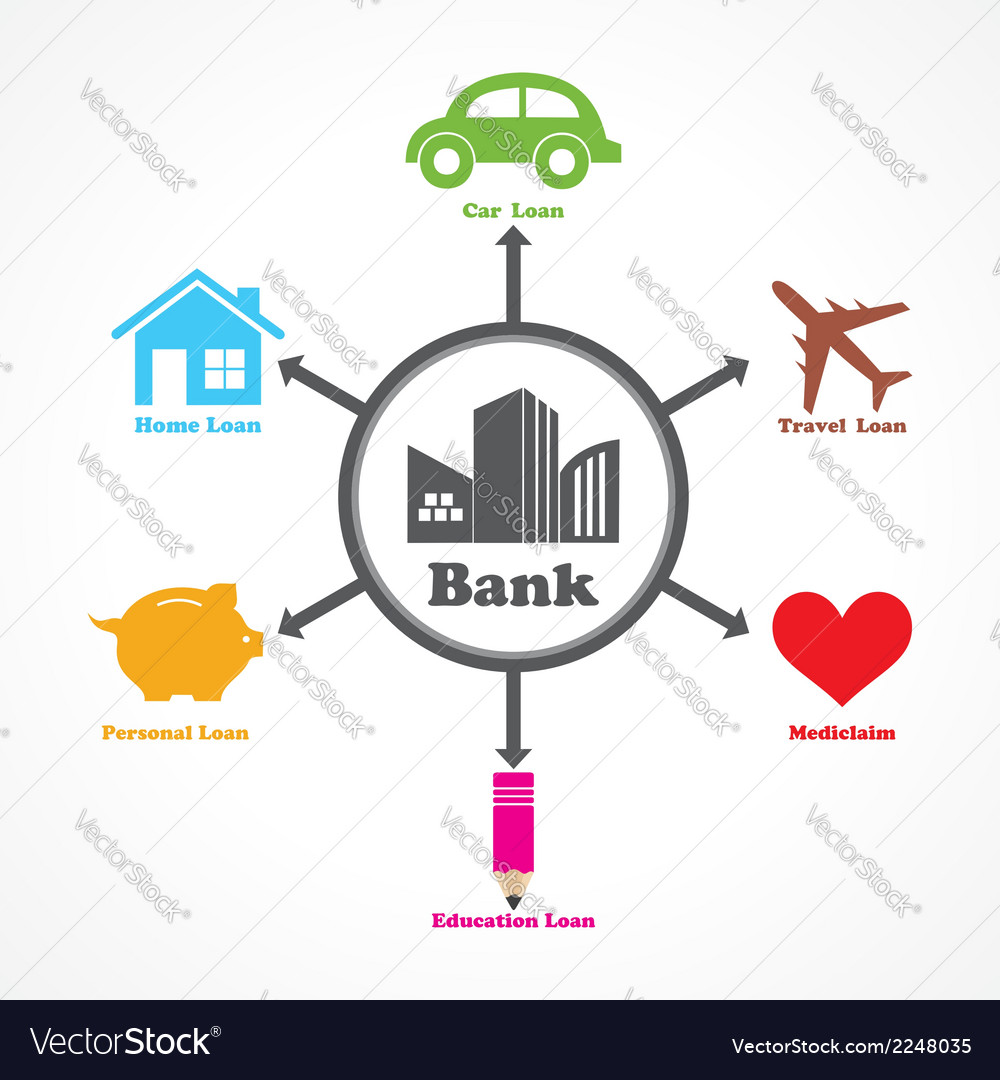

All fundings aren't developed equal. If you need to borrow money, initially, you'll desire to determine which type of finance is best for your scenario.

If you have high-interest bank card debt, an individual car loan may assist you repay that financial debt faster. To consolidate your financial debt with a personal funding, you 'd use for a financing in the amount you owe on your bank card. If you're authorized for the full amount, you 'd utilize the car loan funds to pay your debt cards off, rather making monthly settlements on your personal financing.

That's because the loan provider may take into consideration a protected funding to be less risky there's a possession supporting your loan. If you do not mind promising security and also you're confident you can pay back your car loan, a safeguarded financing might aid you conserve money on interest. When you use your collateral to take out a financing, you run the risk of shedding the residential or commercial property you used as security.

Some Known Facts About Clark Finance Group.

A pawn shop finance is another fast-cash borrowing option. You'll take a thing of worth, like an item of fashion jewelry or a digital, right into a pawn shop as well as obtain money based on the thing's worth. Funding terms vary based upon the pawn store, and also rate of interest rates can be high. But some states have actioned in to manage the industry.

You might likewise get hit with costs as well as extra prices for storage space, insurance or renewing your financing term. Payday alternate financing amounts vary from $200 to $1,000, as well as they have longer payment terms than payday finances one to 6 months rather of the normal couple of weeks you obtain with a cash advance funding.

A residence equity car loan is a sort of safeguarded financing where your residence is used as security to obtain a swelling sum of money. The amount you can obtain is based on the equity you have in your residence, or the difference in between your home's market price and exactly how view website much you owe on your residence.

Given that you're utilizing your house as collateral, your rate of interest with a home equity loan may be lower than with an unsecured individual funding. You can utilize your residence equity finance for a range of purposes, ranging from home improvements to medical expenses. Before taking out a house equity car loan, make certain the payments are in your budget.

How Clark Finance Group Mortgage Broker can Save You Time, Stress, and Money.

She appreciates helping people find means to much better manage their cash. Her work can be found on many web sites, including Bankrate, Finance, Bu Learn more. Learn more.

Borrowed cash can be utilized for several objectives, from funding a new business to getting your fiance an engagement ring. But with all of the different types of fundings around, which is bestand for which purpose? Below are the go to my site most usual kinds of fundings as well as exactly how they work. Key Takeaways Personal car loans and also credit scores cards include high rates of interest yet do not need security.

Cash loan generally have extremely high rate of interest plus purchase costs. Individual Fundings Most banks, online and also on Key Street, provide personal loans, as well as the earnings may be made use of for essentially anything from acquiring a new 4K 3D smart TV to paying bills. This is a pricey way to get money, due to the fact that the finance is unsecured, which implies that the debtor does not install collateral that can be seized in case of default, similar to a vehicle loan or residence mortgage.

Examine This Report on Clark Finance Group

Passion rates can be even more than 3 times that amount: Avant's APRs range from 9 - Clark Finance Group Mortgage broker. 95% to 35. 99%. The very best rates can only be gotten by people with remarkable credit report ratings and considerable assets. The worst must be endured by people who have nothing else selection. A personal loan is most likely the most effective means to go with those who require to borrow a fairly tiny amount of money as well as are certain they can repay it within a number of years.

If the customer falls short to satisfy the pertinent legal obligation with the third celebration, that celebration can demand payment from the bank.

A corporation may approve a specialist's quote, for instance, on the problem that the contractor's bank issues an assurance of repayment in case the contractor defaults on the agreement. An individual car loan could be best for a person who requires to borrow a fairly small amount of cash and ensures their capacity to settle it within a number of years.